Step 2: Initiating a Split Payout Request

The Split Payout feature empowers merchants to allocate funds from a single transaction to multiple beneficiaries. This is ideal for businesses operating in marketplaces, commission-based services, or platforms managing multiple parties. In this guide, we will walk you through the key steps to successfully initiate split payouts using PayTabs APIs.

For a better understanding of the requirements and the whole split payout cycle, we highly recommend you to check our Workflow, Prerequisites & Configurations manuals

The Endpoint and Related Postman Collection

| POST | {{domain}}/payment/request |

|---|

Please note that not using the proper endpoint URL {domain} will lead to authentication issues within your responses. To find the your proper domain you can read ourWhat is my (Region)/(endpoint URL)?tutorial article.

- KSA

- UAE

- Egypt

- Oman

- Jordan

- Kuwait

- Global

https://secure.paytabs.sa/payment/request

https://secure.paytabs.com/payment/request

https://secure-egypt.paytabs.com/payment/request

https://secure-oman.paytabs.com/payment/request

https://secure-jordan.paytabs.com/payment/request

https://secure-kuwait.paytabs.com/payment/request

https://secure-global.paytabs.com/payment/request

Request Parameters

To initiate a payment request using this integration type, there are minimum required parameters that need to be passed with valid information. The specification of these required parameters is clarified below:

- The Minimum Required Parameters

- The Available Optional Parameters

| Parameter | Data Type | Min | Max | Required |

|---|---|---|---|---|

| INT | Accept only valid profile number | ✔ | |

| The merchant Profile ID you can get from your PayTabs dashboard. For more information please check ourHow to get your account information from PT2 Dashboard?tutorial article. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | Valid string from this enum list: sale auth refund register void | ✔ | |

| the identification of the type of the transaction. To know more about these types please check ourWhat is the "tran_type" (transaction type)?solution article. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | Valid string from this list ecom recurringmoto | ✔ | |

| the identification of the category/class this transaction will follow, such as eCommerce, Recurring, etc. To know more about these types please check ourWhat is the "tran_class" (transaction class)?solution article. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ✔ | ||

| Indicates the cart/order id at the merchant end to easily relate the transaction to. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ✔ | ||

| Indicates the cart/order description at the merchant end to easily relate the transaction to. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | Valid string from the following list:SAR AED BHDEGP EUR GBP HKD IDR INR IQD JOD JPY KWD MAD OMR PKR QAR USDAccepts both upper- and lower-case characters | ✔ | |

| Indicates the transaction currency, which the customer will be charged with. To know more about this parameter pleaseclick here. | ||||

| ||||

| DECIMAL | ✔ | ||

| Indicates the amount of the transaction the customer is about to be charged Both min and max values are subjected to the merchant transaction limits. To know more about this parameter pleaseclick here. | ||||

| ||||

| OBJECT | - | ||

| The Split Object which contains, the stakeholders of current transaction. If it is defined at least two entities should be provided. | ||||

| ||||

| INT | ✔ | ||

| Unique Entity Id, defined by the merchant | ||||

| ||||

| STRING | ✔ | ||

| Entity name | ||||

| ||||

| STRING | ✔ | ||

| A brief description for the item. | ||||

| ||||

| STRING | ✔ | ||

| The amount that should be paid for related entity. | ||||

| ||||

| STRING | one of the following values:F = Full MSC is applied to this itemP = Proportional MSC is applied to this itemZ = Zero MSCR = Remainder of MSC | ✔ | |

| ||||

| ||||

| OBJECT | ✔ | ||

| Beneficiary details. | ||||

| ||||

| DECIMAL | ✔ | ||

| Beneficiary Name as defined in the bank. | ||||

| ||||

| INT | ✔ | ||

| Beneficiary account (IBAN, VIBAN) . | ||||

| ||||

| STRING | Only valid country code is accepted. | ✔ | |

| Beneficiary Bank’s country. | ||||

| ||||

| STRING | ✔ | ||

| The name of Beneficiary bank. | ||||

| ||||

| STRING | ✔ | ||

| The bank branch. | ||||

| ||||

| STRING | ✔ | ||

| Beneficiary Phone number. | ||||

| ||||

| STRING | ✔ | ||

| Beneficiary email. | ||||

| ||||

| STRING | ✔ | ||

| Beneficiary address. | ||||

| ||||

| DECIMAL | ✔ | ||

| Beneficiary additional address. | ||||

| ||||

| Parameter | Data Type | Min | Max | Required |

|---|---|---|---|---|

| STRING | 255 Characters (Valid URL) | ❌ | |

| The return URL is the URL that PayTabs will redirect the customer to after he finishes the payment process (whether it's authenticated or not). It will redirect the customer with a POST response that is sent with the client/cardholder redirection through his browser containing the basic transaction information once the payment process ends (whether the customer cancels, paid, or failed to pay). It depends on the customer's actions, which means if the customer closes the browser right after the payment without waiting to be redirected back to your system, you will not receive this response. What is the Return URL vs the Callback URL? To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | 255 Characters (Valid URL) | ❌ | |

| The callback response is a server-to-server POST response that is sent (to a pre-defined HTTPS URL) with the full detailed transaction information once the payment process has ended (whether the customer cancels, paid, or failed to pay). It does not depend on the customer's actions; the response will be sent anyway.What is the Return URL vs the Callback URL? To know more about this parameter pleaseclick here. | ||||

| ||||

| BOOLEAN | ❌ | ||

| Indicates whether to hide shipping and billing information or not from the payment page. Note: The customer details are still required and must be passed in case any of the details are missing or passed with invalid values; the hide_shipping option will be ignored, and the cardholder will be required to enter any of the missing details on the payment page. To know more about this parameter pleaseclick here. | ||||

| ||||

| OBJECT | ❌ | ||

| Indicates the customer details for this payment. If provided, the payment page will be prefilled with the provided data. To know more about this parameter pleaseclick here. | ||||

| ||||

| OBJECT | ❌ | ||

| Indicates the shipping details for this payment. If provided, the payment page will be prefilled with the provided data. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| STRING | ❌ | ||

| ||||

| BOOLEAN | ❌ | ||

| Indicates whether to preview the payment page within the current check page instead of redirection or not. If ✔, preview the redirect URL sent in the response in <iframe> HTML tag, which will preview the whole payment page within this frame. To know more about this parameter pleaseclick here. | ||||

| ||||

| BOOLEAN | ❌ | ||

| Indicates whether to reload the whole page on redirections or just reload the current frame. To know more about this parameter pleaseclick here. | ||||

| ||||

| BOOLEAN | ❌ | ||

| Indicates whether to reload the main base (could be div or another iFrame tag) that contained the payment page framed element. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | en or ar | ❌ | |

| Indicates the payment page displaying language. To know more about this parameter pleaseclick here. | ||||

| ||||

| OBJECT | ❌ | ||

| For more customizations, you can pass to the Transaction API request your own "user-defined fields" up to 9 fields, and accordingly, you would receive those fields in the callback response. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| ||||

| OBJECT | ❌ | ||

| To provide discounts for specific customers.Transactions With Card Discounts To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| provide a comma-separated list of card prefixes (usually first 6, can be up to first 11) To know more about this parameter pleaseclick here. | ||||

| ||||

| DECIMAL | ❌ | ||

| The actual discount should be deducted from the cart_amount. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| Description of the discount that will be displayed for the customer on the hosted payment page. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

| To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | Pass one of the following list: 2 - Hex323 - AlphaNum204 - Digit225 - Digit166 - AlphaNum32 | ❌ | |

| The tokenization format the generated token should follow.Token Based Transactions (Recurring). To know more about this parameter pleaseclick here. | ||||

| ||||

| BOOLEAN | ❌ | ||

| For showing the “save this card” option on the payment page. To know more about this parameter pleaseclick here. | ||||

| ||||

| DECIMAL | ❌ | ||

To know more about this parameter pleaseclick here. | ||||

| ||||

| DECIMAL | ❌ | ||

To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | Pass one or more of the following list: "creditcard" "amex""mada" "urpay" "unionpay" "stcpay""valu" "aman" "meezaqr" "omannet""knet" "knetdebit" "knetcredit "applepay""samsungpay" | ❌ | |

To initiate the payment page with one or more specific payment methods, which should be configured first in your profile. To know more about this parameter pleaseclick here. | ||||

| ||||

| DECIMAL | ❌ | ||

To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

Valid token. To know more about this parameter pleaseclick here. | ||||

| ||||

| STRING | ❌ | ||

Valid transaction reference. To know more about this parameter pleaseclick here. | ||||

| ||||

Request & Response Payload Samples

This section is dedicated give you a sample API request payload using both the above mentioned required and optional parameters, along with showing you the response payload received upon using each request payload.

- Required Parameters Sample Payloads

- Optional Parameters Sample Payloads

The below sample request payload will show you how you can pass the above-mentioned required parameter/s, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Sample Request Payload

- Sample Response Payload

{

"profile_id": **Your profile ID**,

"tran_type": "sale",

"tran_class": "ecom",

"cart_id": "cart_11123",

"cart_currency": "SAR",

"cart_amount": 158.56,

"cart_description": "Description of the items/services",

"split_payout":

[

{

"entity_id": 1000,

"entity_name": "Restaurant",

"item_description": "Meal",

"item_total": "133.56",

"msc_flag": "p",

"beneficiary":

{

"name": "Customer Name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "bank name",

"bank_branch": "",

"email": "demo@paytabs.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

},

],

"callback": "none",

"return": "none"

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "CART#1001",

"cart_description": "Description of the items/services",

"cart_currency": "AED",

"cart_amount": "500.00",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/page/59945B6B********************B481788688",

"serviceId": 2,

"profileId": 9*****4,

"merchantId": 1*****7,

"trace": "PMN****4.63****A8.00****C4"

}

The below sample request payload will show you how you can pass the above-mentioned optional parameter/s, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Sample Request Payload

- Sample Response Payload

{

"profile_id": **Your profile ID**,

"tran_type": "sale",

"tran_class": "ecom",

"cart_description": "Description of the items/services",

"cart_id": "Unique order reference00",

"cart_amount": 25000.2,

"cart_currency": "SAR",

"paypage_lang": "en",

"return":"** Valid Return URL **",

"callback":"** Valid callback URL **",

"split_payout":

[

{

"entity_id": 1000,

"entity_name": "Restaurant",

"item_description": "Meal",

"item_total": "133.56",

"msc_flag": "p",

"beneficiary":

{

"name": "Customer Name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "bank name",

"bank_branch": "",

"email": "email@domain.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

},

{

"entity_id": 1001,

"entity_name": "Agency",

"item_description": "Delivery Fee",

"item_total": "15.00",

"msc_flag": "Z",

"beneficiary":

{

"name": "customer name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "bank name",

"bank_branch": "",

"email": "email@gmail.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

},

{

"entity_id": 1002,

"entity_name": "Tip",

"item_description": "Tip",

"item_total": "10.00",

"msc_flag": "Z",

"beneficiary":

{

"name": "customer name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "Bank name",

"bank_branch": "",

"email": "email@domain.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

}

],

"customer_details": {

"name": "FirstName LastName",

"email": "demo@paytabs.com",

"phone": "0522222222",

"street1": "address street",

"city": "cc",

"state": "C",

"country": "AE",

"zip": "12345"

},

"shipping_details": {

"name": "FirstName LastName",

"email": "demo@paytabs.com",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

},

"user_defined": {

"test": "UDF1 Test",

"test2": "UDF2 Test",

"udf3": "UDF3 Test",

"udf4": "UDF4 Test",

"udf5": "UDF5 Test",

"udf6": "UDF6 Test",

"udf7": "UDF7 Test",

"udf8": "UDF8 Test",

"udf9": "UDF9 Test"

},

"card_discounts":

[

{

"discount_cards" : "41111,520000",

"discount_amount" : "30.00",

"discount_percent" : "25",

"discount_title" : "30.00 SAR and 25% discount on cards starts with 41111, 520000",

}

],

"config_id": 2188,

"card_filter": "411111",

"card_filter_title": "Only accept cards start with 41111",

"tokenise": 2,

"show_save_card": true,

"hide_shipping":true,

"donation_mode":true,

"cart_min":5,

"cart_max":10,

"framed": true,

"framed_return_top": true,

"framed_return_parent": true

}

{

"tran_ref": "TST223XXXXXXXXXX",

"tran_type": "Sale",

"cart_id": "Unique order reference00",

"cart_description": "Description of the items/services",

"cart_currency": "USD",

"cart_amount": "0.00",

"tran_currency": "",

"tran_total": "0",

"callback": "** callback URL **",

"return": "** return URL **",

"redirect_url": "https://secure.paytabs.sa/payment/page/595AXXXXXXXXXXXXXXXXXXXXXXXXXXXX",

"customer_details": {

"name": "first last",

"email": "email@domain.com",

"phone": "0522222222",

"street1": "address street",

"city": "cc",

"state": "AZ",

"country": "AE",

"ip": "197.47.93.193"

},

"shipping_details": {

"name": "name1 last1",

"email": "email1@domain.com",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "DU",

"country": "AE"

},

"split_payout":

[

{

"entity_id": 1000,

"entity_name": "Restaurant",

"item_description": "Meal",

"item_total": "133.56",

"msc_flag": "p",

"beneficiary":

{

"name": "Customer Name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "bank name",

"bank_branch": "",

"email": "email@domain.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

},

{

"entity_id": 1001,

"entity_name": "Agency",

"item_description": "Delivery Fee",

"item_total": "15.00",

"msc_flag": "Z",

"beneficiary":

{

"name": "customer name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "bank name",

"bank_branch": "",

"email": "email@gmail.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

},

{

"entity_id": 1002,

"entity_name": "Tip",

"item_description": "Tip",

"item_total": "10.00",

"msc_flag": "Z",

"beneficiary":

{

"name": "customer name",

"account_number": "SAXX0X0000XXX000XXXXX000",

"country": "SA",

"bank": "Bank name",

"bank_branch": "",

"email": "email@domain.com",

"mobile_number": "+966XXXXXXXXX",

"address_1": "Riyadh",

"address_2": ""

}

}

],

"serviceId": 2,

"profileId": 100181,

"merchantId": 46656,

"trace": "PMNT0403.63A99D49.0003A345"

}

The Payment Flow Experience

Reaching this point, you are now able to initiate a Split Payout request and as you now, the process involves several key steps that ensure a smooth payment and tracking experience for both you and customers. Here’s how it works:

-

Initiating the Request:

Once you initiate a split payout request, you will receive a response that includes a redirect URL. This URL is crucial for guiding your customer through the payment process.

"redirect_url": "https://secure.paytabs.com/payment/page/599452E5B6B********************B4817688",

-

Redirecting the Customer:

You should redirect your customer to this URL as you normally would in a payment transaction. This step allows the customer to complete their payment securely and efficiently. PayTabs then will handle the transaction and ensure that the funds are collected as specified in your split payout request.

-

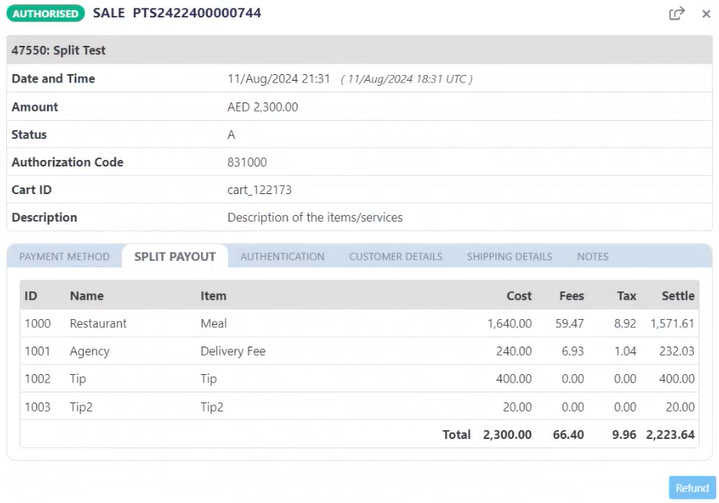

Tracking in the Merchant Dashboard:

After the payment is completed, the transaction will be displayed in your Merchant Dashboard. You can view the details of the split payout in the transaction view. The dashboard will provide a dedicated Split Payout section, showing a comprehensive breakdown of how the funds have been distributed among the designated beneficiaries.

This process ensures that you have full visibility and control over your split payouts, from initiating the transaction to tracking its completion in the dashboard.